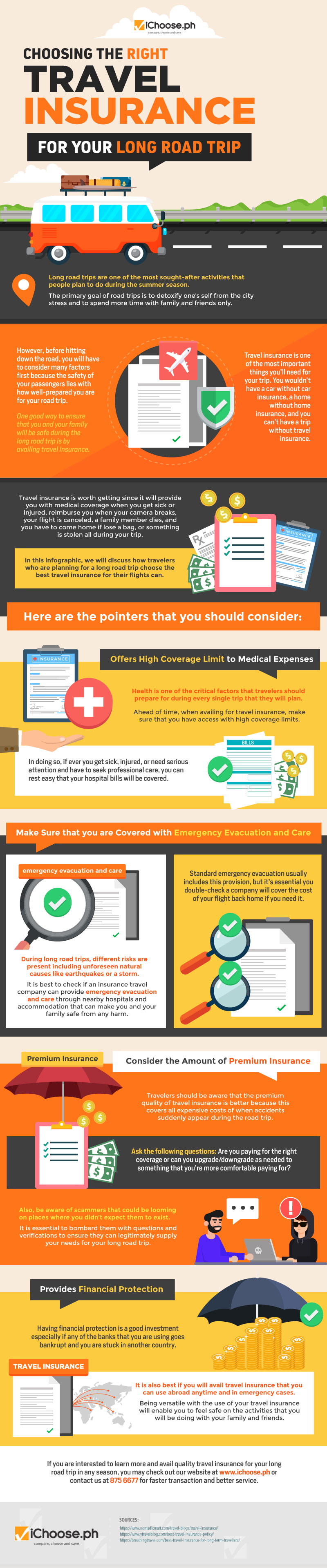

Choosing the Right Travel Insurance for your Long Road Trip (INFOGRAPHIC)

If you are a car owner, you probably have car insurance to make sure that you get paid once your vehicle got into some serious trouble. And if you have a family, you probably want to get health insurance in case they become ill unexpectedly.

So, when you are about to travel in a distant place, why won’t you have travel insurance? Nobody knows when something bad will happen and the best way to ensure that somehow you can pay for it is through availing one. Especially for those who frequently travel like business travelers, travel insurance is a must.

So, what exactly is travel insurance and what are its benefits? For starters, travel insurance covers losses occurred during the trip whether it be medical expenses, lost luggage, accidents, flight cancelations, or any other loss that you might encounter.

Travel insurance can usually be arranged at the time of the booking of a trip to cover exactly the duration of that trip, or a "multi-trip" policy can cover an unlimited number of trips within a set time frame. Some policies offer lower and higher medical-expense options; the higher ones are chiefly for countries that have high medical costs.

There are many travel insurance policies available in the marketplace. If you apply for a credit card, some credit card company offer travel insurance if travel arrangements are paid using credit cards. Travel insurance covers the following:

- Medical treatment

- Cancellation

- Injury or death

- being called as a witness

- termination of employment (provided you did not know about it before you booked the holiday)

- being called up if you are a member of the armed forces or other public defense or safety organization

- prohibition of travel by the government to the intended destination

- officially recommended evacuation from the intended destination

- official advisory against going to or remaining at the intended destination

- death or serious illness of a family member (subject to age restrictions).

- Return of a minor

- Trip cancellation

- Trip interruption

- Overseas funeral expenses

- Lost, stolen or damaged baggage, personal effects or travel documents

- Delayed baggage (and emergency replacement of essential items)

- Flight connection was missed due to airline rescheduling or delay.

- Travel delays due to weather

- Hijacking

If going on a long road trip, travel insurance is also a must. However, not every insurance company is a legitimate one. Millions have been victims of insurance fraud; some even have legitimate insurance but not as good as the benefits others can offer. To make sure that you get the best out of your travels, here is an infographic from iChoose.